Tariffs 101: Why the Price of Your Favorite Stuff Might Go Up

The smallest things in life are connected to money and the economy—even stuff we don’t think about, like that new phone case we ordered online or the clothes we’ve been eyeing. One thing that plays a role in the prices of those things is something called tariffs. Yeah, I know—sounds like one of those words teachers throw around in history class when talking about the Boston Tea Party. But tariffs are actually a pretty big deal today too.

Consistency = Cash: The Power of Branding

When you think of Nike, what comes to mind? Probably their swoosh logo, the phrase "Just Do It," and an overall vibe of athletic excellence. That right there is the power of branding. And guess what? It applies to more than just big companies—branding can help you make money too.

Money Moves: Financial Lessons from Trump’s Economic Policies

Understanding how the government handles money can help you make smarter decisions with your own finances. Listed below are some of the financial policies we might expect from a Trump administration and what they mean for our wallets.

Santa Claus: The Ultimate CEO? What His Business Model Teaches Us About Money

Alright, let’s talk about the OG businessman—Santa Claus. The man runs a global operation, delivers millions of products in a single night, and somehow doesn’t charge anyone a dime. Sounds sketchy, right? But let’s break it down because Santa’s business model actually has some serious financial lessons hidden under all that red velvet and fluff.

How to Build a Powerful Resume

A powerful resume doesn’t come from flashy job titles; it comes from showing that you’re responsible, skilled, and ready to take on challenges. Here’s how to make yours stand out.

How to Get Money When You Have None: Hustle Smart, Not Hard

Starting out with zero cash in your pocket can feel impossible. Whether you're saving for a car, college, or just want to stop asking your parents for every dollar, figuring out how to make money when you have none can feel like trying to build a tower out of thin air. But here’s the thing: you don’t need money to make money. You just need creativity, persistence, and a little hustle.

Goals: The Blueprint for Success

Setting goals might not sound like the most exciting thing (and yeah, parents are always talking about “reaching your fullest potential”), but if you’re serious about making money and getting ahead, it’s actually kind of a must.

How Social Media Can Boost Your Bank Account—and Distract You from Your Goals

Social media’s all over the place, and honestly, it’s got its perks if you’re looking to make some cash. But just as easily as it can be a tool for growth, it can turn into a distraction. So how do you find that line between using it to build your future and letting it pull you away from your goals? Here’s my take as someone who’s learning to balance both.

Guide to Affording College

Paying for college might seem overwhelming, but there are tons of resources out there to help. Start planning now, and you’ll thank yourself later. Scholarships, smart savings, and affordable college options can go a long way toward making your education more manageable—and debt-free!

Kamala Harris vs. Donald Trump: How Their Economic Plans Could Shape Our Future

The future is pretty uncertain right now, especially when it comes to the economy. Who leads our country in the coming years will play a huge role in shaping that future, so I thought I’d dive into what two major political figures, Kamala Harris and Donald Trump, would likely bring to the economic table.

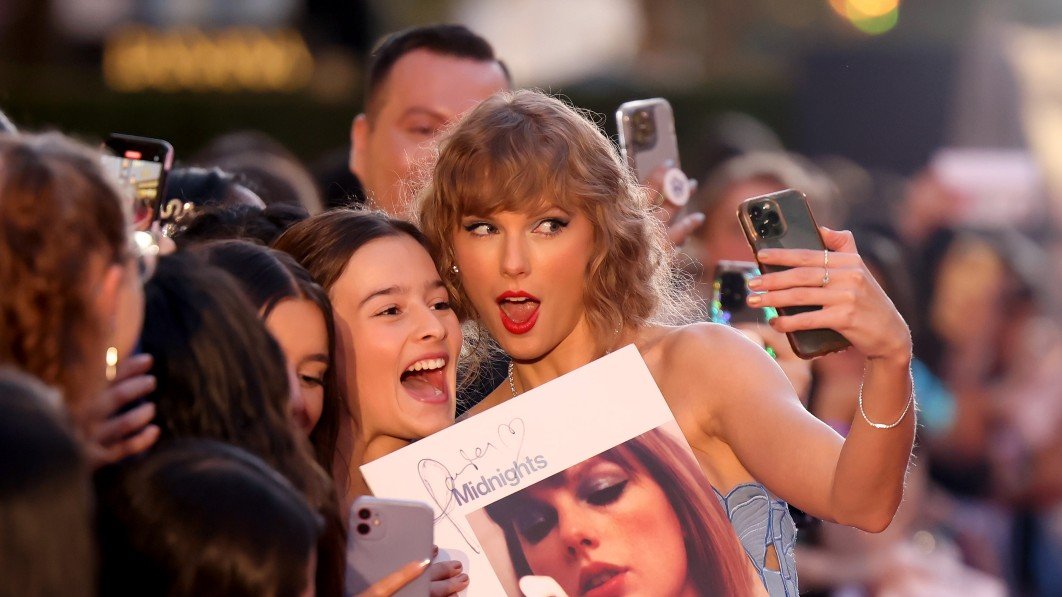

Swift Moves: The Business Genius of Taylor Swift

For anyone who’s trying to build a business, there’s so much to learn from Taylor Swift. Whether it’s owning your work, connecting with your audience, or staying true to your values, she’s proven that smart business moves aren’t just about making money—they’re about building something that lasts. And that’s a lesson I’m definitely keeping in mind as I think about my own future.

Stock Market 101

Do you ever wonder what all the buzz is about the stock market? You’ve probably heard adults talking about it, seen it in movies, or maybe even watched a YouTube video or two. But what exactly is the stock market, and why should we, as teens, care about it?

The Truth About Mental Health & Financial Stress

It’s weird, isn’t it? How the future can feel both so distant and so immediate? As high schoolers think about college, career, and just life in general, it’s impossible not to feel the weight of financial stress. I see it all around me: the pressure to get scholarships, the fear of student loans, and the constant reminder that the economy is unpredictable. And then there’s the quiet, nagging question in the back of your mind: “What if I can’t make it?”

A Lesson in Loans

How much time have you spent thinking about college, buying a car, and eventually, getting a place of your own? One thing that keeps popping up in all these plans is loans. But let’s be honest, loans can be confusing, especially when you're just starting to understand money. So, I did some research and wanted to share what I’ve learned in a way that makes sense for us teens.

5 Questions to Ask Before Jumping into an Investment.

Investing can be a great way to grow your savings, but it's not something you should jump into without doing your homework. Here are five important questions you should ask before putting your money into any investment.

Money Moves: California's New Personal Finance Class for High Schoolers

I know, it sounds a bit dry, but stick with me. This is huge for our future. As Kayvon Banankhah, a high school junior from Modesto, said during a Senate Education Committee hearing, “It’s often the students who need financial literacy the most that receive it the least.” That hit home for me.

Your Network: How Connecting with Others Can Boost Your Net Worth

When we hear the term "networking," it often sounds like something only adults in suits do at business meetings. But in reality, networking is something we do every day, whether we realize it or not. It's all about making connections with people who can support you, guide you, and open up new opportunities.

Unlocking the Power of High Yield Savings Accounts: A Teen's Perspective

You might not think much about saving money right now, but trust me, it’s more important than it seems. I recently discovered high yield savings accounts (HYSAs), and they’re a game-changer for anyone looking to make their money work harder. Whether you're saving up for a car, college, or even just a cool new gadget, HYSAs can help you reach your goals faster. Here’s why they’re awesome and why we should all consider opening one.

Save Yourself with an Emergency Fund.

Building an emergency fund might seem tough, but with a bit of planning and discipline, it’s totally doable. Start small, stay consistent, and you’ll be prepared for whatever life throws your way. Plus, you’ll be building great financial habits that will benefit you for years to come!

Big News for Future Teens & Finance!

Alright, so, check this out. Usually, I'm all about diving into finance stuff and talking about money moves and career paths, but today, I need switch gears. Something big is going down here in California.